The first I realized something was amiss was when I tried to sign into my Chase online banking the next morning and was unable to, with a message saying my online access had been locked out and I'd need to call blah blah number to fix it.Īfter wasting 2.5 hours on hold and being passed around like a hot potato between no less than 7 different Chase "telephone bankers" and call centers, they still could not tell me anything useful about what was wrong with my account or why I was being locked out. Late last week, a few of us in #bitcoin-otc were scammed by someone (GPG-registered and positively rated in the Web of Trust) who was buying Bitcoins and paying with a stolen/hacked Chase QuickPay account. I'm glad I didn't, because now I've also had a problem. When I first read your post about problems using Chase QuickPay, I planned on chiming in by saying 'thanks for sharing your experiences, but for another viewpoint, I've been using QuickPay for dozens of transactions and have yet to have any kind problem'. I can't imagine what the outcome would be if the customer made up a story and claimed it WAS fraud and that he wanted his money back. And there's not much that can be done - not only is Chase "too big to fail", they're apparently "too big to care".īottom line? Chase QuickPay carries a chargeback risk that practically exceeds that of PayPal, because you get surprise chargebacks if you even appear on Chase's fraud radar, even when the customer asserts no such claim. What I think is unacceptable is them locking out a RECIPIENT business account to check on the identity of a SENDER of a relatively small amount of funds, and most importantly, their unilateral and arbitrary reversal of the transactions.

#Chase quickpay changes password

In my mind, this is a perfectly good reason to lock out an account pending a phone call and perhaps a password change, and to put funds on hold, even for several days. Neither time was Chase concerned about me selling "bitcoins" like PayPal is, they were more concerned about hacked accounts. Both times, I was fortunate enough to have the payer contact me, prove his identity at Chase as asked, and pay me again without hesitation. Chase was very clear: they "could not" push the transfers through, they were canceled and that was that.Ĥ. Once my account was unlocked, the payments remained REVERSED (CANCELED), the funds returned to the payer (WHO DID NOT ASK FOR THEM TO BE RETURNED OR EVER CLAIM FRAUD), and Chase told me I needed to ask for the payer to make the transfer again. Their call center was very explicit in telling me that MY account would not be unlocked until that guy visited his branch.ģ. The first time this happened, my business was locked out of an account and access to a balance that was orders of magnitude larger than the payment I received, for over half a day because they wanted the person who PAID ME, half the continent away, to visit a Chase branch and prove his identity. At some point in the same or next day, I find out that Chase has REVERSED the funds transfers, locked out my account, and locked out the payer's account. I have had the following horror story happen exactly twice, on two completely separate sales paid through Chase-to-Chase QuickPay, three or four weeks apart:ġ. That is, if you could count on Chase not to reverse the payments just because they feel like it.

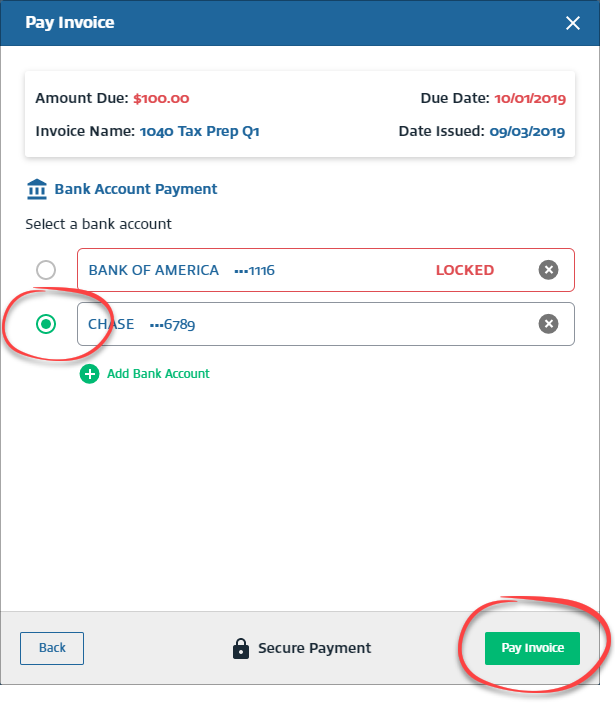

Chase's website bills the QuickPay service for, among other things, being perfect for accepting payments for transactions made online. Chase QuickPay is a neato service that allows Chase customers to transfer money from one Chase account holder to another (instantly), as well as non-Chase customers (but not instantly).

0 kommentar(er)

0 kommentar(er)